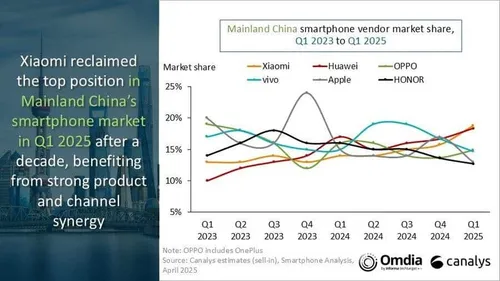

It took a full decade, but Xiaomi is finally back where it once belonged — at the top of China’s smartphone market. According to fresh data from Canalys, Xiaomi claimed a commanding 19% market share in Q1 2025, pulling off a remarkable 40% year-over-year growth. In a landscape as fiercely competitive as China’s, this marks a major shift — and a hard-earned comeback.

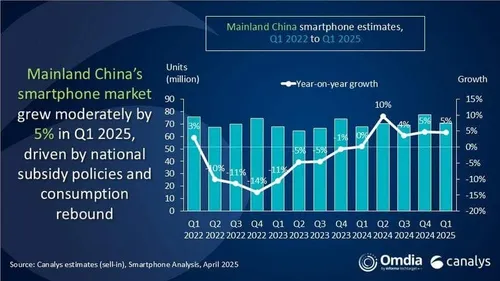

China's Smartphone Market Is Bouncing Back

The numbers tell a bigger story. In the first three months of 2025, China saw 70.9 million smartphones shipped — a modest 5% jump compared to the same period last year. It might not sound explosive, but it’s the continuation of a recovery trend that kicked off in 2024.

What's behind the rebound?

- Government subsidies that encouraged consumer spending

- Overall economic recovery fueling buying confidence

- Rising demand for more refined, feature-rich devices

- A strong comeback for physical retail stores after the pandemic slowdown

Consumers are coming back, and they’re coming back smarter — demanding better value, more innovation, and stronger after-sales support.

Who’s Leading the Pack?

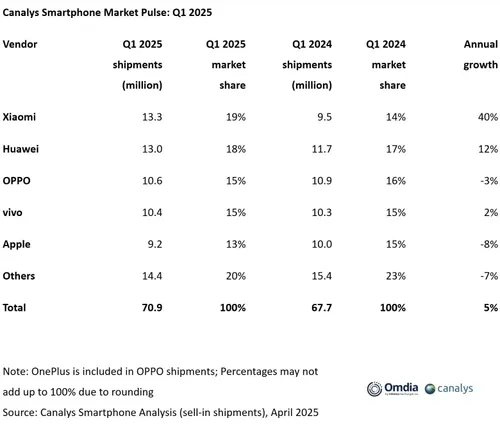

Here's how the top players lined up in Q1 2025:

- Xiaomi: 13.3 million units shipped (19% market share)

- Huawei: 13.0 million units (still showing strong double-digit growth)

- OPPO: 10.6 million units

- vivo: 10.4 million units

- Apple: 9.2 million units (a noticeable 8% drop YoY)

While Xiaomi celebrates its return to number one, Apple’s slide reminds everyone that no position is guaranteed — not even in premium segments.

How Did Xiaomi Pull It Off?

According to Canalys Chief Analyst Zhu Jiatao, Xiaomi’s strategy was a textbook case of smart execution. First, the company adopted a unified pricing strategy across online and offline channels, making life easier for buyers — especially those taking advantage of government incentives.

Second, Xiaomi expanded far beyond smartphones. Its broader product ecosystem played a critical role:

- Wearables (smartwatches, fitness bands)

- Personal computers

- Smart home appliances

- Electric vehicles

By tying multiple product categories together, Xiaomi encouraged bundled consumption. A new phone led to a new smartwatch. A new smartwatch led to a smart air purifier. It created a cycle of loyalty — and it worked.

Huawei Isn’t Out of the Race

While Xiaomi is back on top, Huawei isn’t quietly stepping aside. Fueled by consistent double-digit growth, Huawei is pushing aggressively with foldables like the Mate XT and Pura X, and is betting big on the development of HarmonyOS Next — its own in-house operating system. Analysts believe HarmonyOS could carve out a solid 3% of the Chinese smartphone market by the end of the year.

The competition? It’s far from settled. If anything, the battle for China's smartphone crown just got a lot more interesting.

Popular News

Latest News

Loading