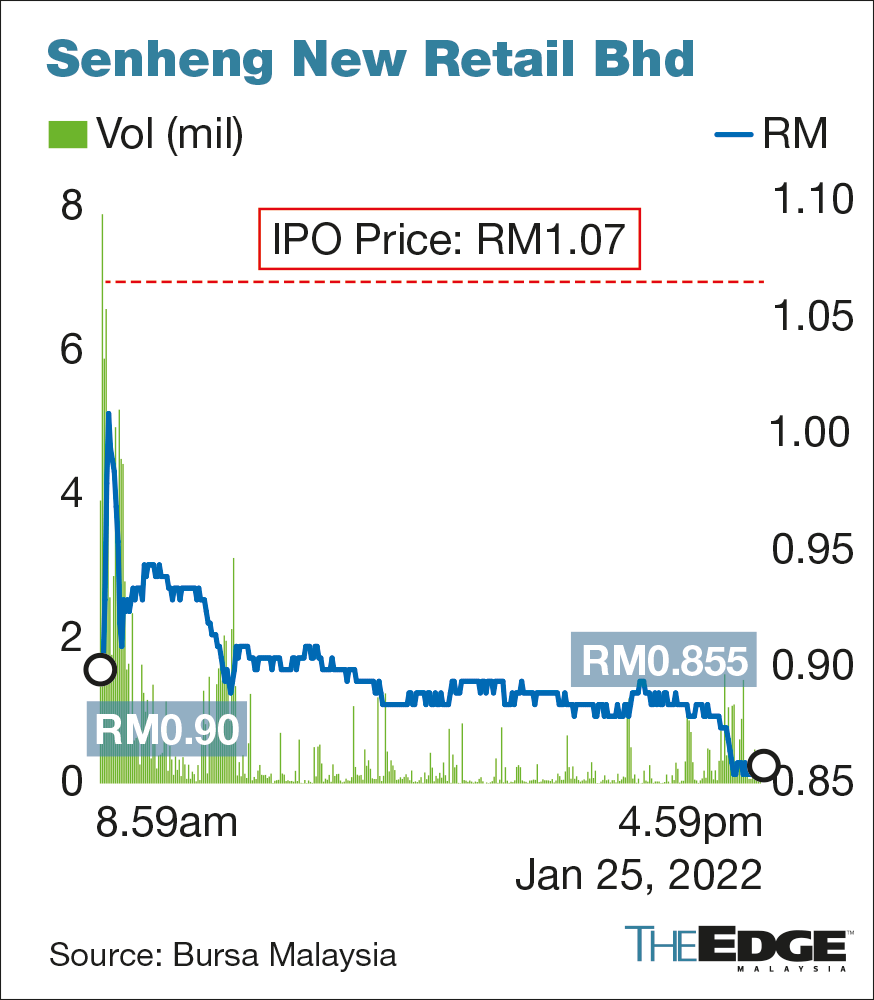

On its first day on the Malaysian Main Market, consumer electrical and electronics retailer, Senheng New Retail Bhd had a terrible performance. Its trading day started at 90 sen ($0.21) and hit a peak of RM1.01 ($0.24) before closing at 85.5 sen ($0.20). The company’s initial public offering (IPO) price is RM1.07. Thus, closing at 85.5 sen represents a 21.5 sen or 20.09% fall from its initial IPO. However, the group still had a market capitalization of RM1.28 billion ($305.4 million).

Nevertheless, the company was quite busy on the day closing as one of the most active traders. It had the second most active stock with about 163.55 million shares changing hands. The trading volume was equivalent to 10.9% of its issued share capital of 1.5 billion. With the public issue of 250 million new shares, the company was able to raise RM267.5 million ($63.8 million).

Senheng is quite popular in the Malaysian consumer market. It is the second-largest electrical and electronics retailer in Malaysia. Senheng has four store categories including Grand Senheng Elite, Grand Senheng, Senheng, and senQ. In Malaysia alone, the company has about 105 physical stores. In addition, it also has online platforms with over 280 brand products in its store.

Despite its disappointing first-day performance, the company is optimistic. Lim Kim Heng, Senheng executive chairman is hopeful that the company can grab another 30% market share. He claims that this is not a difficult feat. Before the advent of COVID-19, the company recorded double-digit growth.

Senheng’s listing did not come at the right time

Regarding the company’s IPO listing, here is what Lim have to say

“[If] you look at the global business environment, it seems like our timing is not very right and, of course, we cannot demand a premium valuation. “But the fundamentals of our business are on the right track. We will be announcing our fourth-quarter results next month and we hope that our investors will be happy. Our focus for the next two to three years will remain on growing revenue, net profit, and the return on investment for our investors,”.

Furthermore, Mr. Lim disclosed that the company does not have any plan to expand overseas. According to him, Senheng will focus on the Malaysian market. It hopes to become a “local champion” within five kilometers of its outlets.

Senheng manages to keep its inventory in place despite the shortage of goods. “We are a bit lucky as we have good relationships with our business partners. We managed to stock up on our inventory to try and offer the same prices for as long as we could until our inventory runs out”…Mr. Lim said.