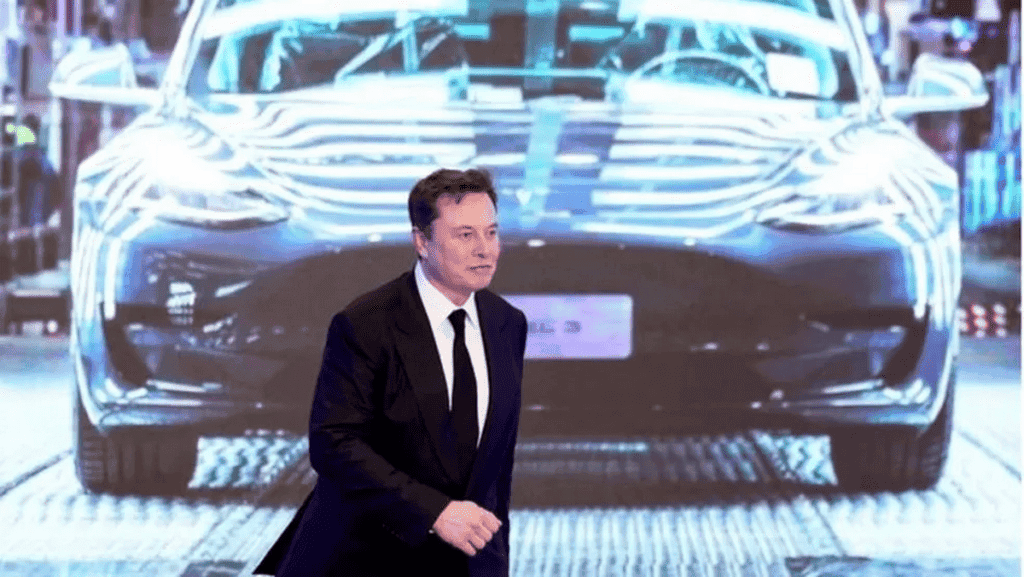

In response to the US Securities and Exchange Commission (SEC) insider trading investigation report, Tesla CEO, Elon Musk responded that his brother did not know he would be on Twitter to launch a sale of Tesla’s stake. The SEC is investigating whether Musk and his brother Kimbal Musk’s recent stock sale “violated insider trading rules” because Kimbal sold the sale a day before Musk launched its probe. Tesla shares fell 5% on the first trading day after the survey was published.

“Kimbal didn’t know I was going to do an investigation on Twitter,” Elon Musk said in an email. He also claims that Tesla lawyers “knew” he was going to conduct a poll. According to his previous settlement with the SEC, Musk’s tweets containing material information required review by Tesla’s lawyers.

“The idea that I care that my brother might lose millions of dollars when he sells stock is completely absurd, given that the vote I initiated on Twitter caused me to lose more than $1 billion on the stock sale.” Elon Musk said.

SEC is investigating Tesla CEO, Elon Musk

Not long ago Tesla, CEO Elon Musk and his brother Kimbal Musk sold shares. The SEC is investigating this, because the sell-off may violate insider trading laws.

Kimble reportedly sold Tesla stock last year worth $108 million. The sell-off came a day after Musk launched a Twitter poll, asking fans if he should sell his 10% stake in Tesla. The SEC has been investigating the matter since last year.

The SEC subpoenaed Musk on Nov. 16, ordering him to provide information related to the financial data. Last week, Tesla and Musk publicly criticized the SEC, saying that Musk’s outspoken criticism of the government has led to the SEC’s endless investigation.

Musk had made a trading plan on September 14, and the sell-off of shares in November was automatic. Fifty-eight percent of voters in the poll thought he should sell, and Tesla shares have fallen about 33 percent since then, days after Musk began selling billions of dollars worth of stock on Nov. 8.

Elon Musk fails to sue SEC: accusation dismissed by judge

The United States federal district judge declined a request by Tesla CEO, Elon Musk to take the U.S. Securities and Exchange Commission (SEC) to court. Musk has previously accused the SEC of harassing him through ongoing investigations and trying to “freeze” his free speech rights but neglecting to assign shareholders a $40 million fine against Tesla and Musk. Moreover, Musk has accused the SEC of leaking information about a federal investigation in retaliation for his public criticism of the agency.

In her order, Judge Alison Nathan noted that the SEC never set a deadline for paying shareholders $40 million. However, she said Musk could file a motion to set a deadline. “Otherwise, the Supreme Court cannot enforce deadlines that do not currently exist,” Nathan said.