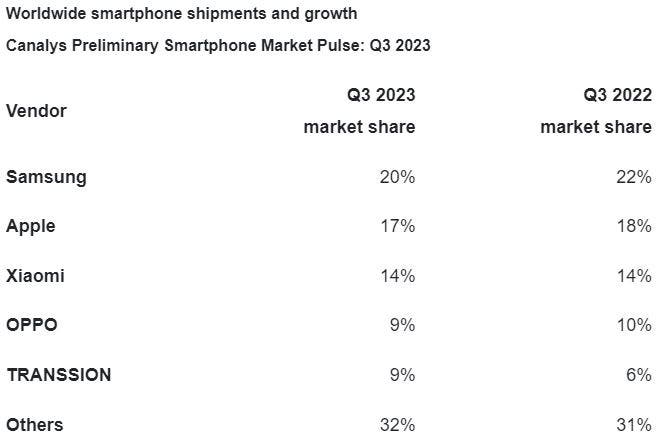

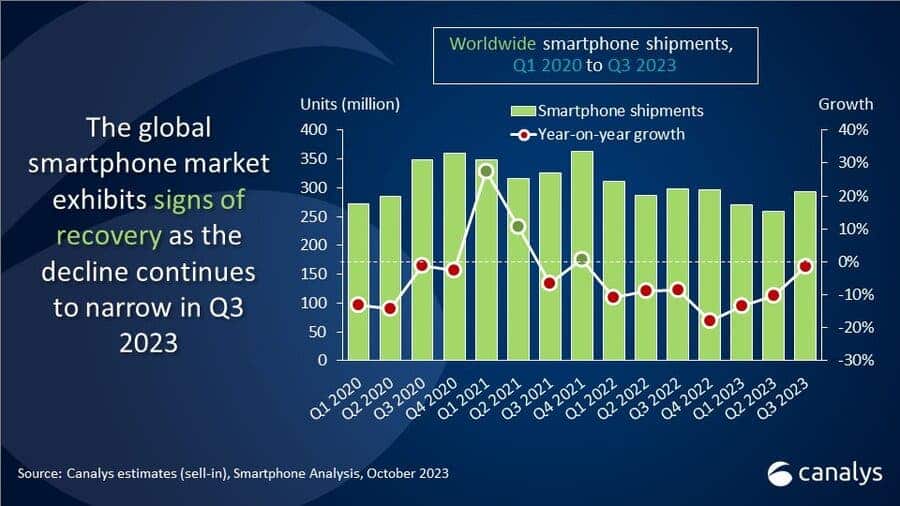

According to Canalys, the global smartphone market fell slightly by 1% to 293.4 million units in Q3 2023, with vendors pushing new models following a healthy inventory level in Q2. Samsung held onto the leading position with a 20% market share, despite a small dip from Q3 2022, while Apple claimed second place with a 17% market share. The decline in the global smartphone market is attributed to global macroeconomic and geopolitical uncertainties. This brought some sort of frailty to the nascent recovery and channel operations. Canalys (Source) forecasts suggest decelerating medium-to-long-term smartphone market growth. Meticulous monitoring of stock turnover and end demand is critical to avoid turbulence from high inventory.

About Canalys:

Established in 1998, Canalys is world-renowned for its research in technology channels and smartphones. Canalys now spans four continents with five offices and employs over 100 people.

Highlights of Canalys report

- Earlier iteration of new folding screen products boosted Samsung and took it to the top spot

- Driven by demand for new iPhone 15 products, Apple followed closely behind. It was able to ship 50 million units, taking a market share of 17%.

- Due to Xiaomi’s strong performance in emerging markets, it ranked third. Its shipments hit 41.5 million units, achieving an annual growth of 2%.

- OPPO (including OnePlus) ranks fourth, with shipments of 26.4 million units and a market share of 9%.

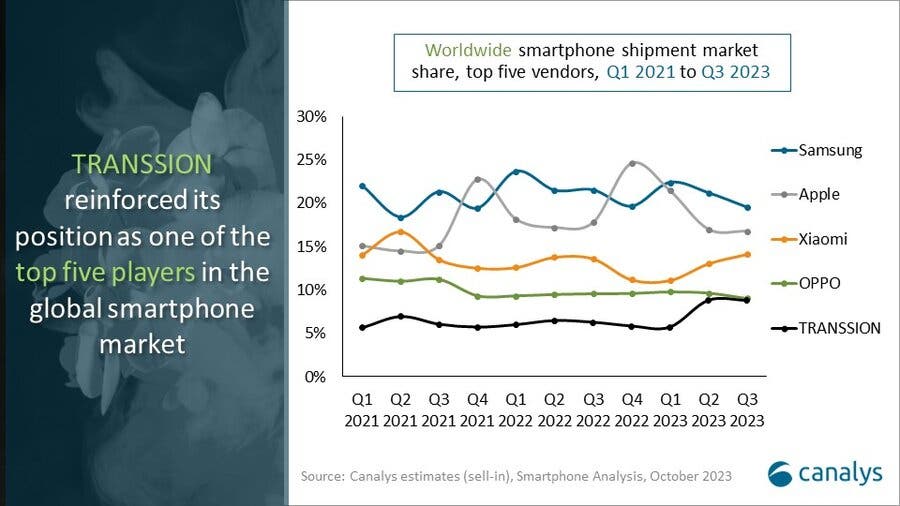

- Transsion (including Tecno, Infinix, and iTel) maintained its fifth position. It also continued its strong momentum from the previous quarter. The company shipped 26 million units, holding its place in the top 5.

Samsung tops sales list

Samsung retained its market leadership with a shipment of 57.4 million units and a 20% market share globally. Many thanks to an early update of its foldable devices. Samsung’s Galaxy Z Flip and Fold 5 series were released two weeks earlier than usual to bolster Q3 2023 revenue and market performance. Samsung’s performance shows early signs of recovery after a tough end to 2022. The rebound is particularly connected to product launches, which drove an increase in sell-in volume. Samsung’s Q3 profit beat expectations, raising hopes for chip recovery.

Other brands

Apple claimed second place with a 17% market share globally and shipped 50.0 million units in Q3 2023. Xiaomi sits in third place with 41.5 million units shipped globally and a 14% market share in Q3 2023. OPPO and TRANSSION shipped 26.4 million and 26.0 million units, respectively, with a 9% market share each in Q3 2023. Other brands accounted for 32% of the global smartphone market share in Q3 2023.

Canalys senior analyst, Sanyam Chaurasia, said that as the holiday season approaches, emerging markets have a growing demand for new products. This drove the development of brands and channels. Xiaomi and Transsion maintained their strong performances from the previous quarter. This makes them the only two vendors in the top five to achieve growth.

Sanyam Chaurasia said

“Xiaomi successfully returned inventory to normal levels in the first half of 2023. It actively released cost-effective entry-level models of the Redmi digital series in emerging markets. This allowed it to regain growth momentum in the third quarter.

At the same time, Transsion’s shipments in its core African market have increased, helping it achieve a staggering 40% year-on-year growth. Despite currency fluctuations and import restrictions in these markets, new demand for upgrades persists. Buyers have gradually adapted to the high-inflation environment.

In the Middle East market, Transsion has captured the growing low-end demand in some low-price markets through its strong local team. In the Latin American market, active channel construction and new product launches have also helped Transsion further expand locally”.

Outlook

Canalys maintains its forecast of marginal declines for 2023. It said shipments will stabilize around these levels in 2022 as we move into the middle of 2023. Decline rates will start to improve soon, although this is more connected to the stark contrast between 2022 and 2023 shrinking.

Canalys research analyst Lucas Zhong believes that brands are seeking opportunities to consolidate their positions in the high-end market. They are working to enhance the competitiveness of high-end product lines and focus on improving product hardware design and software UI.

Lucas Zhong said

“Under this trend, we believe that the competition intensity in the global folding screen market will continue to escalate. Samsung released the Galaxy Z Flip and Fold 5 series two weeks earlier than in previous years. This gave a boost to its revenue and market performance in the third quarter.

However, as the market supply of foldable screen models continues to diversify, this trend will also pose a challenge to Samsung’s current dominance in this market segment. OPPO strategically launched Find N3 and OnePlus Open models in different regions. This shows the ambition of Chinese brands to enter the global folding screen market.

In addition, excessive differentiation among the iPhone 14 series has also caused Apple to face demand issues. It reduced USB Type-C and Smart Island to standard models in the iPhone 15 series to narrow the gap. With this, it was able to stimulate demand and consolidate its high-end market position.

Android brands are building an ecosystem

Lucas Zhong also said that Android brands are working hard to build an ecosystem to compete with iOS. Users are increasingly willing to switch camps for a better ecological experience. This has also led major brands to begin developing operating systems and enhancing their brand image.

For example, the Huawei Mate 60 series provides a complete ecological experience through a self-developed SoC and HarmonyOS. Xiaomi’s new HyperOS has also improved the interconnection experience between multiple devices and has become a recent focus. The system is expected to open up multiple revenue growth curves for the brand beyond mobile phones.

However, the key to the success of a brand OS still depends on whether it can provide users with a unique and attractive experience. Therefore, brands still need to continue to invest in collaborative research and development of software and hardware.

Final Words

Canalys predicts that the global smartphone market will achieve moderate growth in 2024 under cautious conditions. Mobile brands expect to have relatively healthy inventory levels at the end of 2023. There will be enough room to rebuild inventories in preparation for a potential demand recovery.

However, performance will diverge between regions due to risk factors such as regional conflicts and geography. Therefore, brands need to remain flexible in their development strategies to seize growth opportunities in specific regions.

In addition, brands also need to closely monitor terminal demand in different regions to strategically optimize resource allocation and avoid demand fluctuations. At present, mid- to long-term market growth still faces bottlenecks due to factors such as extended replacement cycles in major markets.