As the year 2023 inches towards its conclusion, Canalys, a leading market research firm, has unveiled a comprehensive forecast report, providing insights into the anticipated global smartphone shipments not only for this year but also for the subsequent four years. The forecast brings a mix of positive and challenging news for smartphone vendors.

Smartphone Market: Recovery and Growth Ahead

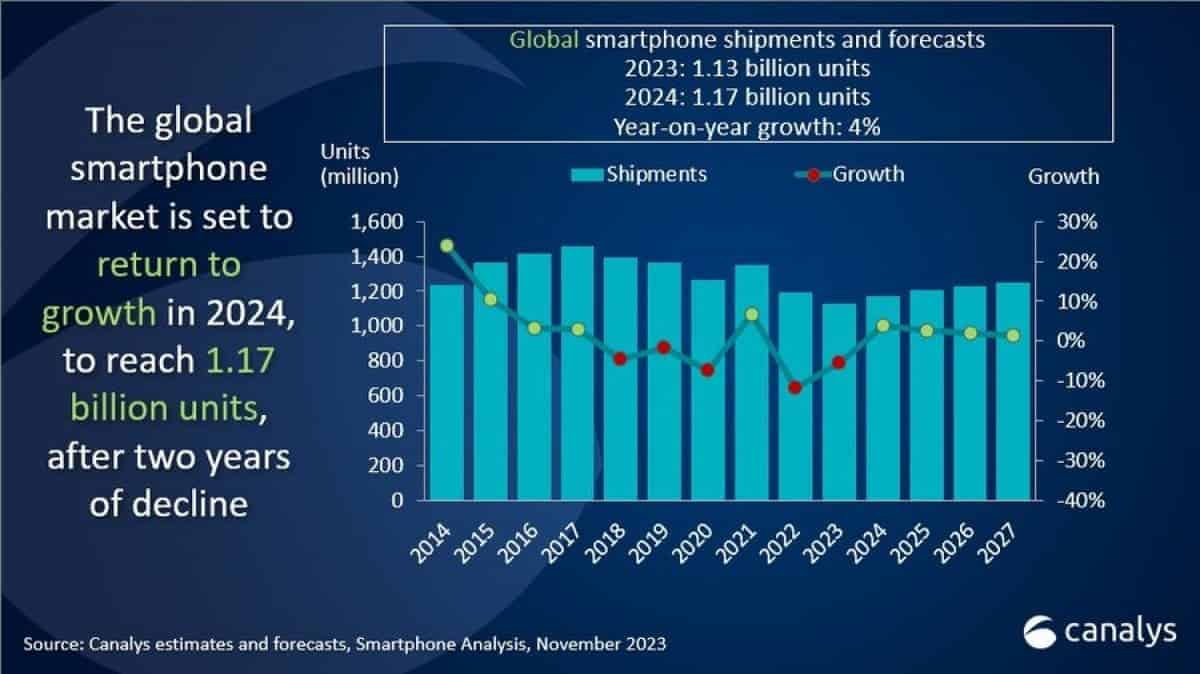

In the immediate outlook for 2023, there is a glimmer of recovery in certain markets. Notably, Latin America is projected to witness a 2% growth, while Africa and the Middle East are expected to experience more substantial recoveries with 3% and 9% growth, respectively. Despite these regional improvements, the global smartphone shipments for 2023 are estimated to reach 1.13 billion units, reflecting a 5% decline compared to the figures recorded in 2022.

“The smartphone industry is clearly emerging from its darkest days, even as the shipments remain over 20% below its 2017 peak,” stated Toby Zhu, Senior Analyst at Canalys. “The good news is that consumers are placing more value on their devices than ever before, with average selling prices now exceeding US$440 versus US$332 in 2017. Profitability is looking up for hardware makers strategically launching flashy new features to captivate consumers in key growth markets.”

Looking ahead to 2024, the forecast paints a more optimistic picture. Canalys predicts a surge in global smartphone shipments, reaching an estimated 1.17 billion units. This represents a notable 4% annual growth compared to the anticipated numbers for 2023.

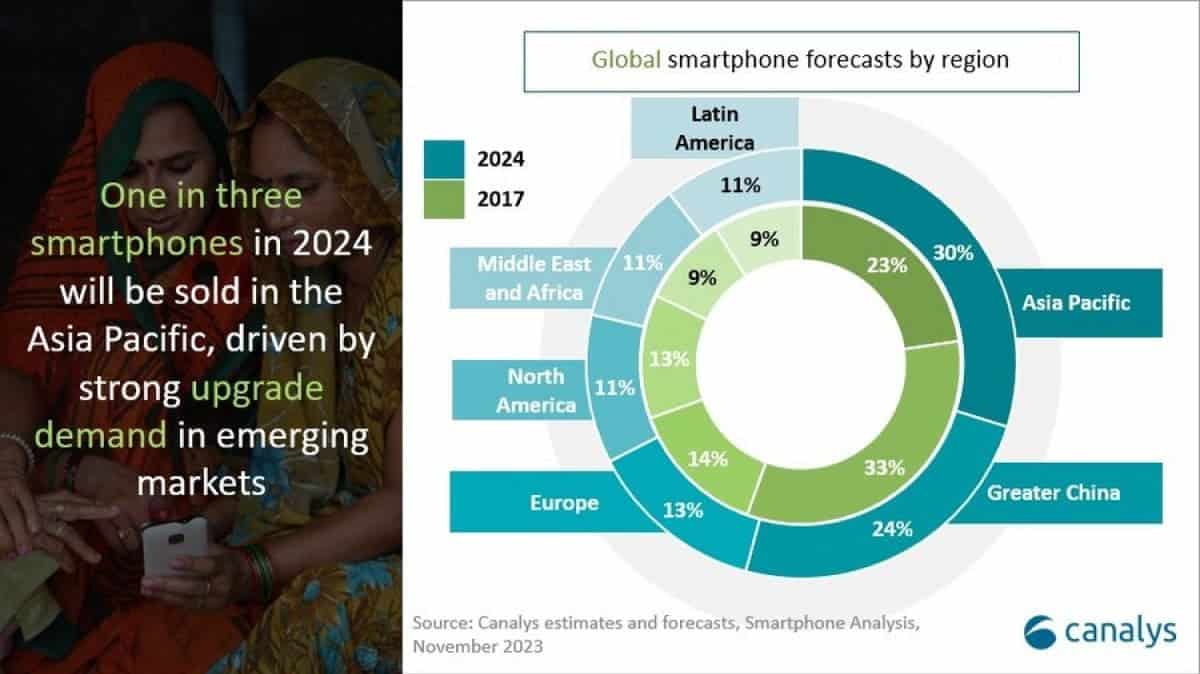

“The smartphone rebound in 2024 will be fueled by emerging markets, where the devices remain integral to connectivity, entertainment and productivity,” said Sanyam Chaurasia, Senior Analyst at Canalys. “One in three smartphones shipped in 2024 will be purchased in the Asia Pacific versus only one in five back in 2017. This region will also witness some of the fastest growth at 6% year-over-year, driven by resurging demand in India, Southeast Asia and South Asia. As macroeconomic conditions and consumer confidence stabilize in these countries, smartphone upgradation will accelerate.”

A key highlight from the report is the increasing willingness of consumers to invest more in their smartphones. The average selling price has risen to $440, signaling a shift in consumer behavior towards higher-end devices. Emerging markets, particularly in the Asia Pacific region, are poised to be the driving force behind the growth in 2024. This includes dynamic markets like India, South Korea, Vietnam, Indonesia, and Malaysia, collectively contributing to 33% of all new smartphone shipments.

“On-device AI capabilities will have limited impact in driving high-end smartphone upgrades in 2024,” cautioned Runar Bjørhovde, Analyst at Canalys. “We expect less than 5% of smartphones shipped next year to be equipped with advanced AI-capable chipsets that can run on-device AI models. The growth of premium smartphones has plateaued out as replacement demand in developed markets like Western Europe and the US remains weak. Many consumers in these markets already upgraded to high-end devices during the pandemic when discretionary cash was abundant. A real growth cycle in premium devices in these regions likely would not occur until 2024-2025, when AI features and use cases become compelling enough to motivate upgrades.”

Encouragingly, the report anticipates stability in smartphone shipments due to growing consumer confidence and improving macroeconomic conditions. With the exception of North America, all major markets will witness growth in 2024. The Asia Pacific, Middle East, and Africa regions will experience a 6% year-on-year growth, while Europe is expected to lead with a 7% annual growth.

“With improving business conditions in 2024, Chinese players like HONOR, TRANSSION and Xiaomi are expected to aggressively expand outside Greater China rather than playing defense,” added Zhu. “Despite persisting geopolitical uncertainties, competition is expected to rise, especially in high-growth emerging markets. Still, optimism is growing among channels, vendors and the supply chain.”

Looking further into the future, Canalys envisions a sustained upward trend in demand, with smartphone shipments projected to reach 1.25 billion units by 2027. This optimistic outlook reflects the resilient nature of the smartphone market, driven by technological advancements, changing consumer preferences, and a recovering global economy.

Key Trends Shaping the Future of the Smartphone Market

Several overarching trends are shaping the future of the smartphone market. These include:

-

5G Adoption: The rollout of 5G networks will have a transformative impact on the smartphone industry. Enabling faster data speeds, lower latency, and the proliferation of new applications and services.

-

Artificial Intelligence (AI) Integration: AI is becoming increasingly integrated into smartphones. Enabling features such as voice recognition, natural language processing, and personalized recommendations. AI will play a crucial role in future developments. Such as augmented reality (AR) and virtual reality (VR) experiences.

-

Focus on User Experience and Privacy: Smartphone manufacturers are placing greater emphasis on user experience and data privacy. This includes providing intuitive and user-friendly interfaces, as well as robust security measures to protect user data.

-

Demand for Sustainable Practices: Consumers are increasingly demanding environmentally friendly products. Prompting smartphone manufacturers to adopt sustainable practices in their production and supply chains.

-

Emerging Markets: Emerging markets represent a significant growth opportunity for smartphone manufacturers, with increasing demand for affordable and reliable devices.

Future Outlook

The smartphone market will continue its growth trajectory, albeit at a slower pace compared to the past decade. This growth will be due to factors such as increasing smartphone penetration in emerging markets, the adoption of 5G technology, and the integration of AI into new applications and services.

However, the smartphone market is also facing challenges, including the maturity of the developed market, increasing competition, and the need for innovation to differentiate products. Smartphone manufacturers will need to adapt to these challenges by focusing on user experience, data privacy, sustainable practices, and emerging market opportunities to maintain their competitive edge.

In conclusion, the smartphone market will continue its evolution and growth in the years to come. The industry will be shaped by technological advancements, consumer preferences, and global market trends. Smartphone manufacturers that can successfully navigate these trends and deliver innovative and user-centric products will be well-positioned to succeed in the dynamic and ever-changing smartphone landscape.