The global component shortage has affected all fields related to electronics. The smart speakers market should have been no exception. But as Strategy Analytics proves, total smart speaker and smart display shipments grew 10% year-over-year to 39.3 million units. This is a record quarter (Q3) after the flat Q2 when there were only 39 million units shipped worldwide.

A year ago, we wrote: Smart Speaker Market ‘Dying’: No One Can Save It

The new report from Strategy Analytics shows that sales of the smart displays in Q3 increased by 19% YoY to 11.2 million units. Moreover, the vendors shipped 7% more basic smart speakers than last year. However, interestingly, 18 models out of 50 sold in Q3 2021 were smart displays. Among them, the Google Nest Hub tops the list. It has managed to sell over 1.5 million units. The second place belongs to the Amazon Echo Show 5 and the Baidu Xiaodu Zaijia 1c.

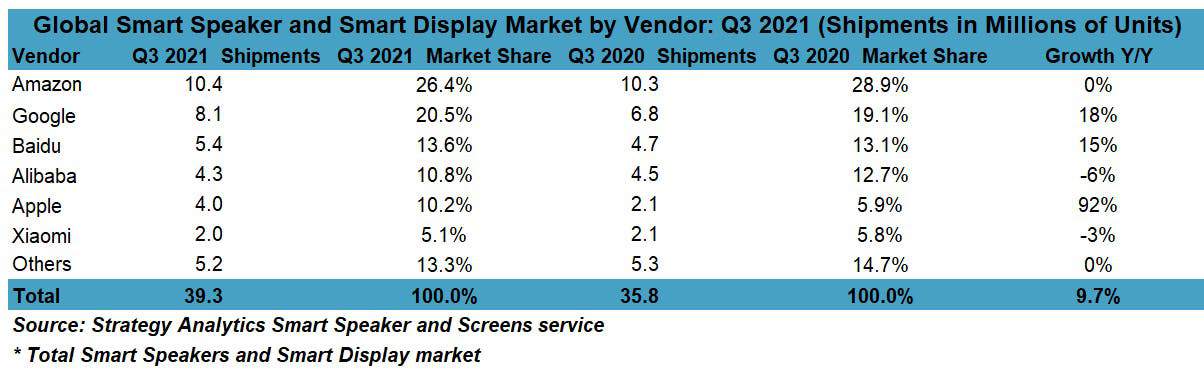

In terms of brands, like Q2 2021, Amazon remains the most popular brand in the smart speakers market. It is followed by Google, Baidu, Alibaba, and Apple, respectively. Amazon shipped 10.4 million smart speakers globally; Google shipped 8.1 million units; Baidu is third with 5.4 million shipments; Alibaba sold 4.3 million smart speakers; Apple was the fastest grower, increasing its shipments by 92% compared to 2020 and reaching 4 million units.

What is more interesting, the gap between the top brands and the rest companies continued to expand. This is because these companies dominate low-end ($50 to $99) and ultra-low-end ($49 and less) price segments.

What Strategy Analytics Says About Smart Speakers Market?

“While our earlier forecasts showed we expected the market to return to stronger growth levels in 2021 if component supply constraints eased, this scenario is not playing out,” noted David Watkins, Director, Intelligent Home. “China alone typically accounts for 30% to 40% of the global market each quarter, so challenges experienced by Alibaba, Baidu, and Xiaomi will be indicators for how well – or not – China is managing its supply chain issues. The contract manufacturers partnered with these three, and dozens of other smart speaker and smart display brands, are settling in for a prolonged period of supply chain issues.”

Jack Narcotta, Principal Industry Analyst, Smart Home, added, “While the first half of 2021 in the global smart speaker and smart display market was a return to form as vendors capitalized on pent-up demand from 2020, the lingering, if not intensifying, issues of shipping and logistics challenges, component shortages, and the Delta and Omicron variants of the COVID-19 virus in the second half of 2021 are hanging heavy on this market. It is likely this market’s growth will not return to pre-COVID levels until at least 2023.”