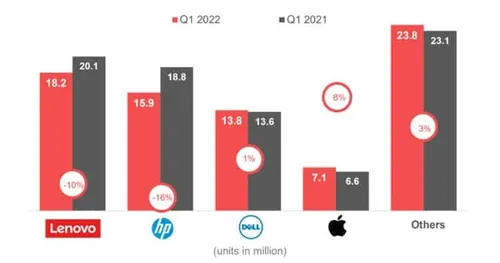

Global personal computer shipments declined in the first quarter of 2022

news

Our checks suggest the PC supply chain turned relatively conservative on shipment outlook in the middle of Q1 2022; largely dragged by global inflation and regional conflict, which brought uncertainties to PC demand and blurred the overall PC shipment momentum ahead. The overall PC shipments in 2022 are expected to be shy of our forecasts made at the end of 2021. In addition, COVID-19 lockdowns in China, especially in Shanghai and Kunshan, where many laptop manufacturing lines are located, will cause shipment correction in April. Compared to OEMs, ODMs currently face more issues related to manufacturing resource allocation than component shortage impacts.

Global personal computer shipments declined in the first quarter of 2022

In the past two years, the PC supply chain has spent much effort dealing with demand uncertainties caused by COVID-19 and component shortages. But since late 2021, demand-supply gaps have been narrowing, signaling an approaching end to supply tightness across the broader ecosystem. Among all PCs and laptops, the supply gap for the most important components such as power management ICs, Wi-Fi and I/O interface IC has narrowed. We have seen OEMs and ODMs continuing to accumulate component inventory to cope with uncertainties arising from COVID-19. Combined with the abovementioned consumer and Chromebook demand weakness, we believe component shortages are going to ease in H2 2022.

Loading