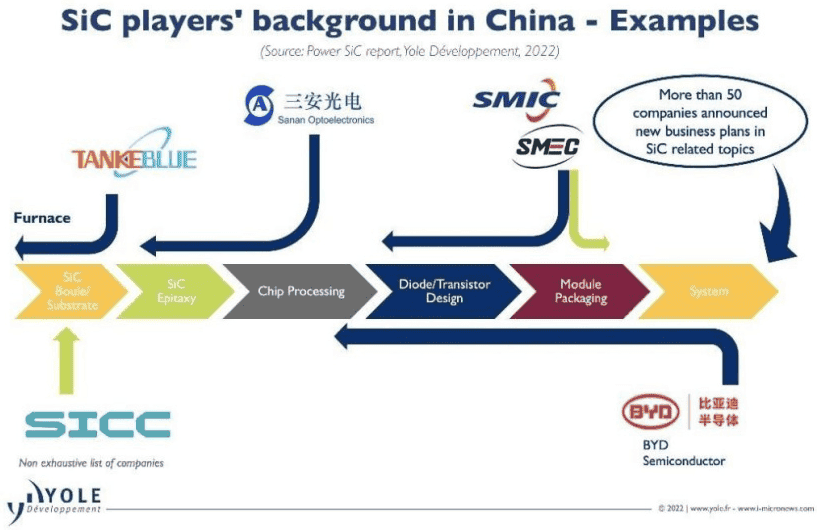

Recently, Yole Développement, a French semiconductor consulting agency, released the latest research report on global silicon carbide (SiC). The report shows that the SiC device market will reach $6.3 billion in 2027. Poshun Chiu, a senior analyst at the agency, commented: “SiC is a booster for the development of power semiconductors. There is also a lot of room for development in the 1200V high-voltage field. It will grow rapidly in the future.”. Many companies with a deep layout in SiC, including STMicroelectronics, Wolfspeed, ON Semiconductor and Infineon Technologies, have announced their long-term and short-term goals. Although each player chooses a different path, the roadmap for their business model is clear. There are more than 50 semiconductor companies in mainland China involved in the SiC business, as shown below:

ST’s SiC modules have been used in the Tesla Model 3 for several years. The company is also expanding its own 8-inch SiC fab. ON Semiconductor has taken an important step in 2021 with the acquisition of a SiC wafer supplier-GT Advanced Technologies. Infineon’s SiC device business will grow by 126% in 2021, far exceeding the company’s average growth rate of 57%. The 800V fast charge from Infineon has the deal for Hyundai Ioniq5. Adding this to its solid foundation in industrial applications, the company is now in the fast lane.

China is taking the lead

Wolfspeed claims that its future business will mainly focus on SiC. The company decided a few years ago to undergo a major restructuring and sold its LED business. With its leadership in SiC wafers, Wolfspeed has begun rolling out 8-inch fabs. At the same time, after the acquisition of Si Crystal, ROHM is also continuously expanding the production capacity of SiC devices and wafers for vertical integration. Furthermore, II-VI has deepened its partnership with General Electric by demonstrating automotive-grade 1200V devices.

According to the report, SiC’s initial wafer cost accounts for more than 60% of the epitaxial wafer cost for 1200V SiC MOSFETs. 8-inch SiC wafers are a key step in scaling up production, and IDM is developing its manufacturing capabilities for 8-inch SiC wafers. However, in Yole’s view, 6-inch will remain the leading platform for the next five years when it comes to SiC power semiconductors. The 8-inch platform will also begin mass production in 2022.

In terms of related technologies, DISCO has developed laser cutting technology to increase production. Also, Infineon has mastered Cold Split technology for mass production. The report shows that in the next five years, the main application scenario of SiC will still be in the field of electric vehicles.