TikTok has become the platform of choice for many users to discover new songs and help push songs into the mainstream. Now, TikTok appears to be getting closer to launching its own standalone music streaming service. In May of this year, TikTok parent company ByteDance filed a trademark application for “TikTok Music” with the U.S. Patent and Trademark Office. The company is seeking to apply the trademark to various goods and services, including a mobile phone that allows users to “buy, play, share, Download Music, Songs, Albums and Lyrics” mobile app. TikTok is already quite popular in the U.S. and Americans will probably love TikTok Music. However, competing with Apple Music and Spotify will be a herculean task.

Other possible use cases for the trademark include an app that allows users to “live audio and video,” as well as the ability to “edit and upload photos as playlist covers” and “comment on music, songs, and albums.”

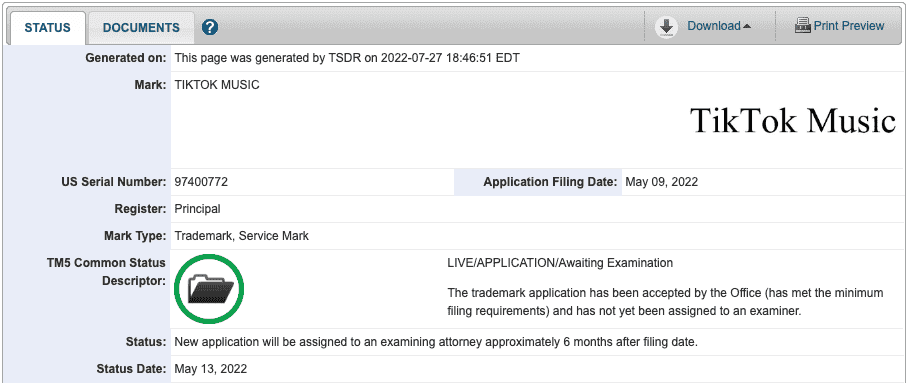

ByteDance first filed a trademark application for “TikTok Music” in Australia in November last year, followed by an application in the United States on May 9. The idea that the company will launch a standalone “TikTok Music” streaming service in the U.S. to compete with the likes of Spotify and Apple Music isn’t unfounded. Currently, ByteDance already operates a streaming app called Resso in India, Brazil and Indonesia. Resso has been stealing market share from other streaming companies over the past year.

TikTok diverts advertising revenue – hurting many U.S. social platforms

As TikTok’s business grows, it has become a competitor that big companies like Meta and YouTube can’t ignore. When asked in October 2019 whether TikTok was a friend or rival of his business, Snap CEO Evan Spiegel chose the former.

“We absolutely see them as friends,” Spiegel told investors on Snap’s third-quarter 2019 earnings call. “They’re co-developers. As far as Snap Kit is concerned, they’re our advertising partners. Most importantly, I think the value they provide to their community is completely different from the value we provide to our community.”

Spiegel’s view of the company’s business relationship with TikTok may not be so good now. Snap reported its second-quarter earnings this week, and the dismal quarterly earnings were another sign of slowing ad spending. It is also another sign that TikTok is continuing to gain market share, giving more leverage to its rivals in the social media space.

In addition to competition from TikTok, Snap and other large technology companies have also been affected by Apple’s privacy policy adjustments. There is an increase in global economic uncertainty, and frequent supply chain problems. However, TikTok has gradually become a thorn in the side of competitors. Meta and Snap even directly acknowledge the threat the TikTok app poses to their businesses on recent earnings calls.

TikTok ranks third after Facebook and Instagram

Market consultancy Insider Intelligence ranks TikTok as the third-largest social platform after Facebook and Instagram. It will triple its digital ad revenue this year to nearly $12 billion, more than Twitter and Snapchat combined.

“TikTok is a rival that no social media giant can ignore,” said Laura Hoy, an equity analyst at investment services firm Hargreaves Lansdown. “TikTok is doing the same thing in the same space. That’s the problem with social media. Users are fickle and you never know how fast their attention spans can change.”

TikTok’s growth doesn’t affect every platform exactly the same. Its short-video platform competes more directly with YouTube’s business and social entertainment apps like Snap’s instant messaging. However, when it comes to ad revenue, every company is competing for the same piece of the pie.

“Spiegel and his team are right to think that Snapchat usage is not influenced by TikTok,” said Rich Greenfield, co-founder of investment bank LightShed Partners. “But the problem is, there’s definitely competition for ad spend, and probably more than they realize. Now they’re dealing with a money-sucking ad monster like TikTok that’s putting pressure on Meta, YouTube, and every business.”

TikTok scares some Americans

While Snap is an American company, TikTok is Chinese. The growth of TikTok in the U.S. is worrisome to some Americans. Snap is keeping up with market trends with various innovations but TikTok in turn copying other companies’ capabilities. Some analysts even worry that Snapchat will be replaced by TikTok.

Snap CFO Derek Anderson acknowledged the impact of TikTok during a Q&A session with analysts on the earnings call, saying: “Whether it’s competing with TikTok or any established company in the space,” he said. It’s getting worse.”

Snap’s Gen Z user base makes it particularly vulnerable to competition from TikTok, which is rapidly gaining popularity among the same audience. According to market research firm Forrester, TikTok is “more sticky”. The study found that 42 percent of U.S. online users aged 18 to 25 thought TikTok was addictive, while only 21 percent thought Snapchat was addicting.

Jasmine Enberg, a principal analyst at Insider Intelligence, said that Snapchat was once the most important instant messaging app. However, as Spotlight’s content creation capabilities continued to improve, it began to dabble in the TikTok business.

TikTok is rattling the entire U.S. ad market

In addition to Snap, TikTok is also a confidant of Facebook owner Meta. Meta has tweaked several core products this year, most recently putting its own TikTok rival, Reels, at the top of its Facebook and Instagram platforms. The aim of this is to boost user engagement in its short-video business.

Surveys show that users are ditching Facebook and Instagram for TikTok and Snap. According to data.ai, an app analytics platform, TikTok’s monthly time spent per user increased by 40% in the first quarter of this year compared to the first quarter of 2021.

“While they can copy and paste TikTok’s features, they can’t copy and paste TikTok’s thriving community of users and creators. They need to keep investing and doubling down,” Mike Prox, vice president, research director, Forrester Proulx said.

TikTok has surpassed YouTube in terms of usage time. According to research by data analytics firm App Annie, users spend an average of 23.6 hours a month on TikTok. This is even more than the 23.2 hours that users spend on YouTube. YouTube has also launched its own short-video feature, Shorts, which it claims has surpassed 30 billion daily views. This is about four times what it was a year ago. However, some ad buyers say that neither YouTube’s Shorts nor Meta’s Reels are getting enough interest. Thus, they may not warrant a large ad spend to get the desired effect.