Xiaomi Turns Up the Volume: Modest 1.5% Growth in a TV Market Catching Its Breath

xiaomiSunday, 10 August 2025 at 01:02

The global TV market isn’t exactly roaring back — but it’s not standing still either. Xiaomi, for its part, managed to sneak in a 1.5% bump in TV Sales during the first half of 2025. Not huge, but enough to keep its spot as the world’s fifth-largest TV brand. Industry tracker TrendForce says global shipments hit 92.5 million units in the first half, up 2% from last year. That’s a modest gain, helped along by China’s trade-in subsidies and a dash of tariff uncertainty that nudged some buyers to act sooner rather than later. Together, the top five brands — Samsung, TCL, Hisense, LG, and Xiaomi — now command just over 65% of the pie.

Chinese Brands Are Pushing Hard

The real movers? TCL and Hisense. TCL’s shipments jumped an impressive 12.5%, while Hisense grew 7.3%. Both are clearly in “full speed ahead” mode, leaning into aggressive pricing and broad international pushes.

Xiaomi’s growth looks tame in comparison, but there’s a certain charm to its slow-and-steady approach. The company knows its audience — value-minded buyers who want solid tech without the premium-brand markup — and it’s sticking to that playbook. Meanwhile, Samsung flat-lined, and LG slid just over 1%, suggesting the balance of power is still shifting eastward.

Mini LED: The New Showpiece

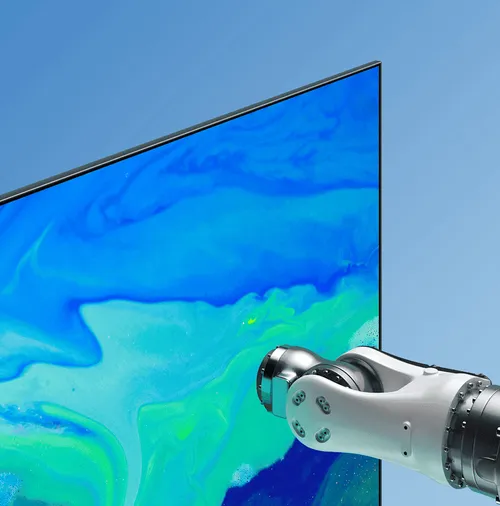

One area where Xiaomi’s keeping pace with the leaders is Mini LED TV sales. TrendForce expects shipments of these advanced screens to spike 67% in 2025, hitting almost 13 million units. TCL, Hisense, and Xiaomi are expected to own roughly 62% of that market.

For Xiaomi, Mini LED isn’t just a buzzword — it’s a chance to bring richer colors and higher brightness to a price bracket where rivals can’t easily follow. Subsidies in certain markets don’t hurt either.

Challenges on the Horizon

It’s not all smooth sailing. Panel costs remain high, making deep discounts tricky, and tariffs are still unpredictable. Chinese policy changes could also tap the brakes on domestic sales. An early shipment push in Q1 gave the industry a 6.1% bump — 45.59 million units — but that may have just pulled demand forward from later in the year. Because of that, TrendForce trimmed its full-year forecast slightly to 195 million units, a 1.1% drop from 2024.

Xiaomi’s Next Moves

The U.S. TV market posted 2–3% growth in H1, though it’s unclear whether the pace will last. Xiaomi isn’t banking on it. Instead, it’s doubling down on emerging markets and leaning into its bigger vision: turning TVs into the centerpiece of a connected home.

If you buy into Xiaomi’s ecosystem, your TV stops being just a screen — it becomes the control hub for lights, appliances, and even your robot vacuum. That’s the kind of integration that could quietly lock in customers, even if the global TV market stays stuck in first gear.

Loading