Almost half smartphones in 2022 will be equipped with AMOLED displays

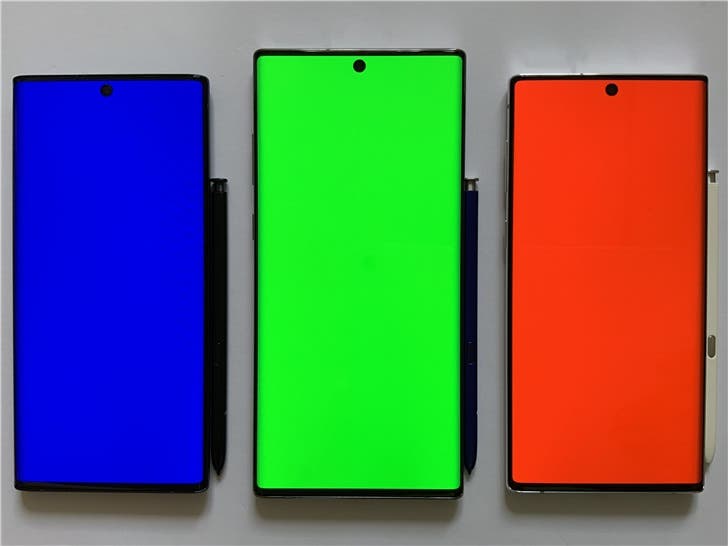

Samsung

As AMOLED panels see increased adoption, the consumption of AMOLED DDI will undergo a corresponding increase as well. However, not only are the process technologies in use for AMOLED DDI manufacturing currently in short supply; but some foundries are also yet to finalize their schedules for expanding their AMOLED DDI production capacities. Due to the lack of sufficient production capacity, the increase in AMOLED panel shipment may potentially be constrained next year.

Almost half smartphones in 2022 will arrive with AMOLED displays

Regarding process technologies, the physical dimension of AMOLED DDI chips is generally larger in comparaison to other chips, meaning each wafer yields relatively fewer AMOLED DDI chips, and more wafer inputs are therefore in need for their production. The vast majority of AMOLED DDI is currently in manufacturing with the 40nm and 28nm medium-voltage (8V) process technologies. In particular, as 40nm capacity across the foundry industry is in tighter supply compared to 28nm capacity, and TSMC, Samsung, UMC, and GlobalFoundries are the only foundries capable of mass producing AMOLED DDI, an increasing number of new wafer starts for AMOLED DDI are being migrated to the 28nm node instead.

Regarding wafer supply, the foundry industry is currently unable to fulfill client demand for 12-inch wafers. Hence, 12-inch capacities allocated to AMOLED DDI production are relatively in a limit as well. At the moment, only TSMC, Samsung, and UMC are able to allocate relatively adequate wafer capacities; although their capacity expansion efforts are still falling short of growing market demand. In addition, while SMIC, HLMC, and Nexchip are developing their respective AMOLED DDI process technologies, they have yet to confirm any mass production schedules. TrendForce therefore expects that the additional AMOLED DDI capacities next year will remain scarce, in turn further limiting the potential growth of the AMOLED panel market.

Loading