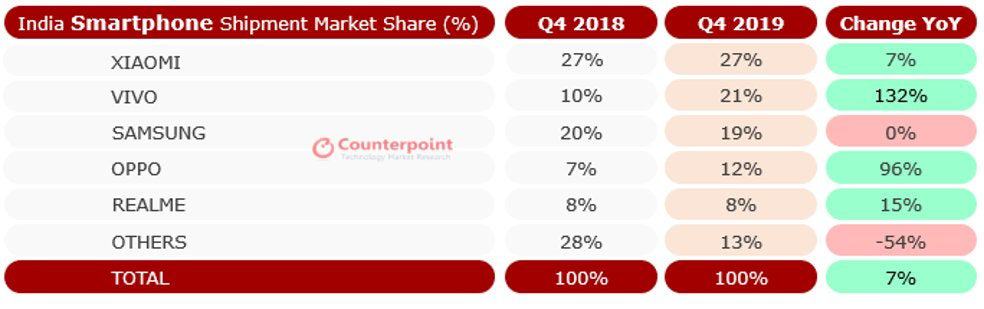

Counterpoint Research has released its Q4 report on the Indian smartphone market and the results are shocking. Vivo performed so well that it secured the second position from Samsung. Xiaomi is still the leader with Oppo and Realme at fourth and fifth positions respectively.

Q3 2019 was the best performing quarter for all the smartphone companies in India, thanks to the Diwali festive season. On the other hand, Q4 was comparatively slow but not bad either especially for Vivo, which saw a whopping 134% YoY in the last quarter and 76% YoY in the whole year of 2019. The company’s S series of smartphones sold well offline in the ₹15,000 to ₹20,000 price segment. Above all, its performance in the last quarter made Vivo the second-largest brand in the country for the very first time with a 21% market share.

Out of all the top major players, Realme’s market share slipped almost half that it dropped one position and was ranked fifth with an 8% market share, compared to Oppo which had 12% market share securing the fourth place. Oppo’s A5, A9 2020, and A5 2020 were the star of the company’s Q3 2019 sales. As for Realme, it grew 255% overall in the last year and entered the premium segment with its Realme X2 Pro in the last quarter of 2019.

Gizchina News of the week

Samsung was the only company to have a flat YoY growth in Q4 2019 and additionally, it saw a 5% YoY decline overall in 2019. The brand’s Galaxy A and Galaxy M series performed well especially Galaxy A50s, Galaxy A30s, Galaxy M30s, and Galaxy A20s. But it needs to ‘double-down to keep any momentum going’, as per Counterpoint Research. Samsung had a 19% market share in the last quarter securing the third position.

Talking about Xiaomi, the Indian market leader for straight two years, showed 7% YoY in Q4 2019 and 5% YoY overall in 2019. However, the growth rate has been now dropped to single-digit as the company serves a large base of customers. The company’s Redmi Note series lineup performed very well through the year, a result of which, India became the largest market for the brand followed by its home country China.

Q4 2019 also saw the highest market share for Trasnssion Group, comprising of brands like Itel, Infinix, and Tecno. These brands performed well in tier 3 and tier 4 cities as well as rural regions of India. Itel was the number one brand in the entry-level (₹4,000) segment, whereas Infinix and Tecno also had good YoY growth in ₹6,000 to ₹10,000 price segment by introducing phones with 6.6-inch displays, 20:9 aspect ratio, 5,000mAh battery, and more.

Lastly, Apple also showcased growth in Q4 2019, thanks to multiple price cuts of iPhone XR and local manufacturing. Further, the company also brought the newer iPhone 11 series to the country faster than before and priced them aggressively especially the standard iPhone 11.