Realme brand has entered the market in 2018 and was originally created to compete with Xiaomi in India. And in this local market, the company has achieved significant success. Its share is growing inexorably and in the fourth quarter of last year, it managed to take 17% of the market share.

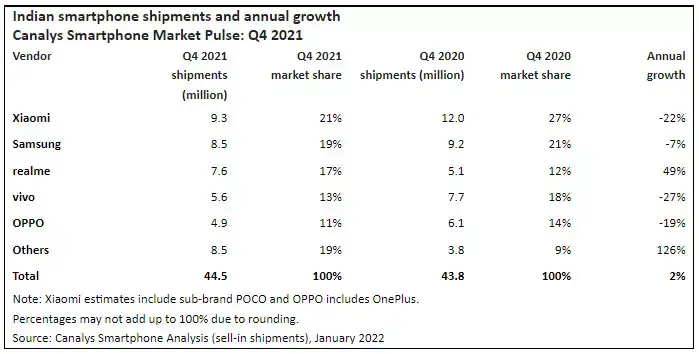

This conclusion was made by analysts from Canalys, who analyzed the results of the companies’ performance in the last decade of last year. According to their calculations, Realme managed to ship about 7.6 million smartphones and is the only brand from the top 5 largest manufacturers in India to show growth. A year earlier, its share was 12% and an annualized growth of 49%.

Realme came third in the Indian market and made it to the top three for the first time. The number one company was Xiaomi, which controls 21% of the smartphone market, which is 6% lower than last year. In quantitative terms, the shipment amounted to 9.3 million. Samsung was in second place with a result of 19% against 21% a year earlier, and managed to ship 8.5 million handsets.

Vivo and Oppo came in fourth and fifth with 13% and 11% respectively in the Indian market. In total, 44.5 million smartphones were shipped in the fourth quarter of last year, compared to 43.8 million a year earlier.

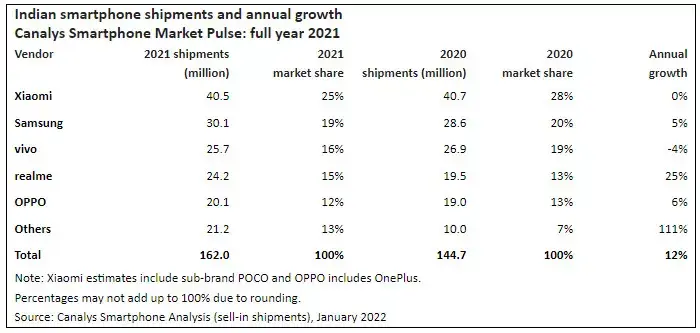

If we consider the indicators for the whole of 2021, then Realme became the fourth with 24.2 million delivered smartphones, and the annual increase was 15%. At the top of the top 5 was Xiaomi, which controlled 25% of the Indian market and had 40.5 million shipped mobile phones. In second place is Samsung, whose share was 19% against 20% in 2020.

India’s smartphone market overcame pandemic problems and supply constraints to grow 12% in 2021

“India smartphone market dynamics shifted every quarter in 2021,” said Canalys Analyst Sanyam Chaurasia. “COVID-19 crises, volatile consumer demand and supply chain disruptions plagued the market this year. Vendors adapted to the changing environment by focusing on omnichannel, diversifying their supply chains, and expanding their product mix. For example, vendors like realme and Samsung diversified chipset configurations to effectively manage supply. Realme’s record shipment total was possible due to innovations in planning and stock management; which led to good supply of mass-market smartphones such as Narzo 50A and C11. At the same time, thanks to the vaccination rollout, market reopening and pent-up demand; smartphone shipments reached all-time highs for the full-year. Growth will continue in 2022, driven by both replacement demand and new customers migrating to smartphones.”

“India will see a vast digital transformation this year,” added Chaurasia. “2022 will bring 5G spectrum auctions with new radio frequency ranges; and 5G will become significantly more accessible in terms of coverage and price. Smartphones capable of 5G will fall further in price amid fierce vendor rivalry; but shipments will be stifled in H1 2022 before the component shortage eases. Overall, India will see upward momentum towards future-proof technologies; with smartphones being at the core of the digital ecosystem and growing ever-more essential to the daily lives of Indian citizens”.