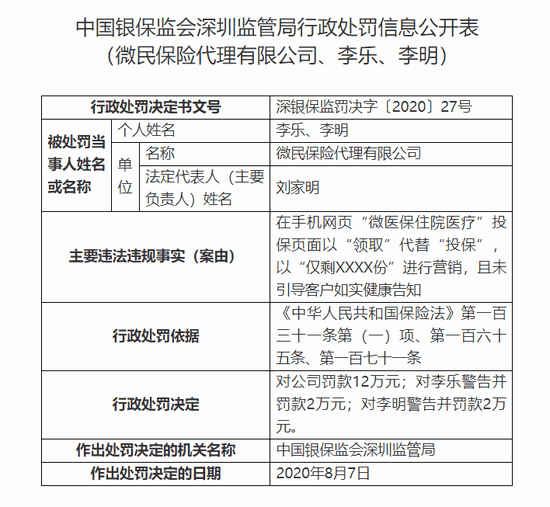

Tencent has its arms spread and a lot of businesses; for those who don’t know Tencent is a majority stockholder in Weimin Insurance Agency Co., Ltd. Today, the administrative penalty information form published by the Shenzhen Banking and Insurance Regulatory Bureau; shows that Weimin Insurance Agency Co., Ltd; had replaced the term “insured” with “receive” on the “Wei Medical Insurance Hospitalization”; insurance application page on the mobile web page, and marketed as “only “XXXX copies left”; while failing to guide the customers to truthfully inform them of their health conditions; and was fined an amount of RMB 120,000. At the same time, the responsible persons’ Li Le and Li Ming have been issued warnings and are fined 20,000 yuan respectively.

Article 131 of Insurance Law in China: Weimin Insurance Agency Co Fails to Follow

Article 131 of the “Insurance Law of the People’s Republic of China”; states that insurance agents, insurance brokers and their practitioners shall not conduct the following activities in handling insurance business activities:

- Defrauding insurers, applicants, and insured persons Or the beneficiary

- Conceal important information related to the insurance contract

- Hinder the applicant from fulfilling the obligation of truthful notification provided by this law; or induce him to fail to perform the obligation of truthful notification provided by this law

- Give or promise to give The insured, the insured or the beneficiary’s interests beyond those stipulated in the insurance contract

- The use of administrative power, position or professional convenience and other improper means to force; induce or restrict the insured to enter into an insurance contract

- Forgery or alteration without authorization Insurance contracts, or providing false certification materials for parties to insurance contracts

- Embezzlement, withholding, or misappropriation of insurance premiums or insurance money

- Using business convenience to seek illegitimate benefits for other institutions or individuals

- Collusion with insurance applicants, The insured or the beneficiary defrauds the insurance money

- Disclosure of the business secrets of the insurer, the insured, and the insured that is known in business activities.

According to Public information services which shows that Weimin Insurance is Tencent’s first holding insurance platform. The company was established back on October 19, 2016, with a registered capital of 350 million yuan. The company’s CEO and chairman are Liu Jiaming. The following is the original text of the administrative penalty information disclosure form:

Tencent Gains Permissions to Sell Insurance via WeChat and QQ

Back in 2017, Chinese Internet giant Tencent has obtained the green light from regulators so to sell insurance via online platforms such as WeChat and QQ. The official website of the China Insurance Regulatory Commission (CIRC) has revealed that Weimin Insurance Agency Co., Ltd, in which Tencent holds a 57.8% equity stake, has garnered approval to engage in insurance agency operations. The approval gives Weimin Insurance the go-ahead to engage in the agency sale of insurance products and agency receipt of insurance fees as well as to conduct damage surveys and provide compensation in relation to insurance operations.