Apple Surges 37% While Xiaomi’s Early Launch Strategy Backfires in China

AppleFriday, 28 November 2025 at 08:29

The results are in from China's huge Singles’ Day event, and they show a massive shift in market power. Counterpoint Research confirmed overall smartphone sales grew just 3%. The growth was driven almost entirely by Apple’s incredible 37% surge. Without Apple, the market would have shrunk by 5%. Meanwhile, one of Apple’s main rivals, Xiaomi, saw its sales fall by 11%. This shows the big risk of changing product timing in such a key promotional month.

The iPhone 17's Simple Secret to Doubling Sales

Apple had a standout performance. The standard iPhone 17 was the main winner. Its sales doubled compared to last year's model. Why? Apple upgraded the storage, added a bigger camera module, and included better sensors. Best of all, they kept the price the same. That is a brilliant value move. My quick take: Apple finally made the base model excellent. They gave users real, visible improvements. That made the Pro model less necessary for most people. Even with discounts on the Pro models (around $42 off), the standard iPhone 17 was the true growth engine. This kind of precise product positioning is key to success in China.

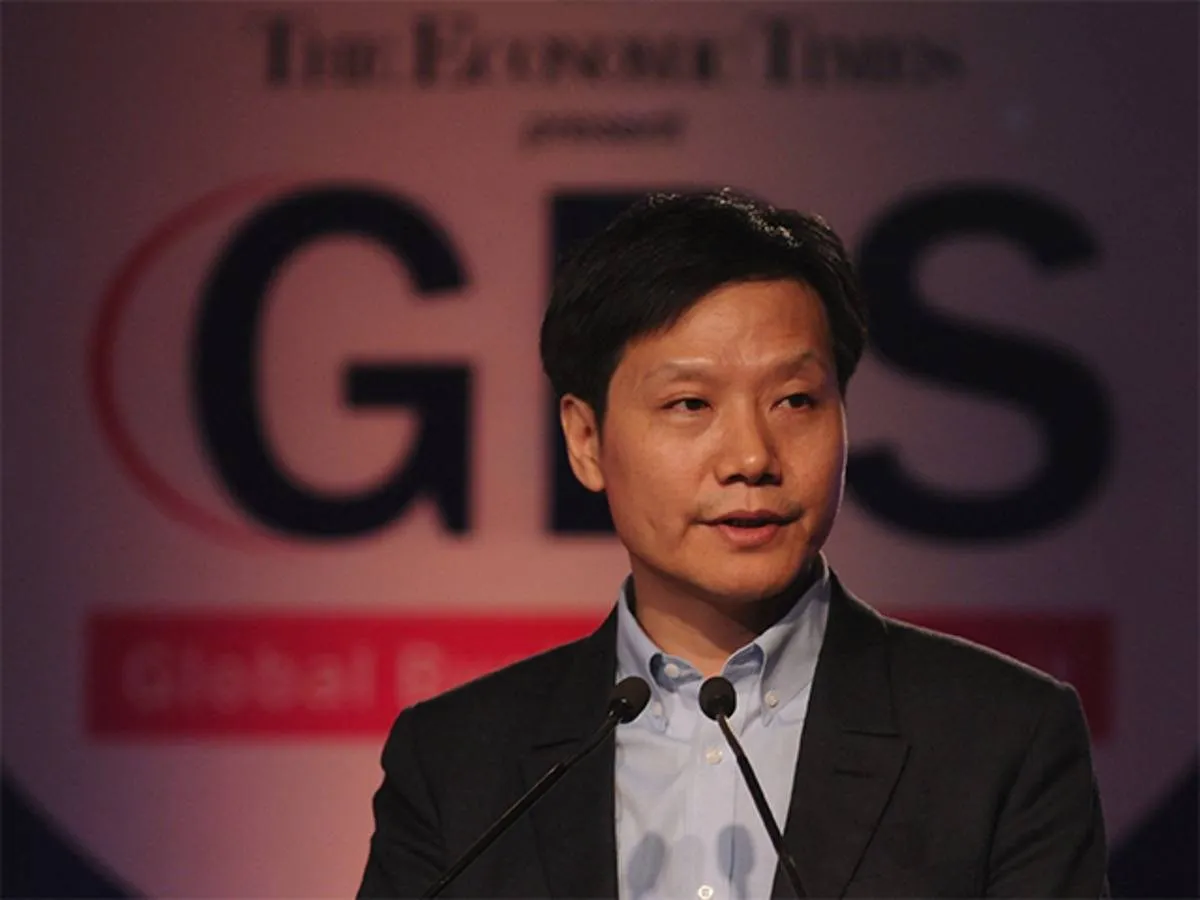

Why Did Xiaomi Fall by 11%?

Seeing Xiaomi, a brand famous for huge 11.11 sales, drop 11% is surprising. The reason isn't failure; it's strategy.

The Xiaomi 17 series launched much earlier this year. Its main sales peak happened a full month before Singles' Day. When the 11.11 promotions started, buyer attention had already moved on. Older Xiaomi devices just couldn't keep up. This hurts the short-term sales volume. But this early launch strategy might raise the brand’s Average Selling Price (ASP). It lets them grab top-end users before the competition heats up. Xiaomi chose a higher price tag earlier, but it cost them big volume during the biggest holiday sale. It's a calculated gamble.

Read also

Headwinds for China's Local Brands

The market shifts affected other local players, too. Huawei was down 22%. This happened because their Mate 80 series launched two weeks after the sales event started. They missed the main traffic window. Honor also saw a 14% drop, probably because of poor product timing in the middle of their cycle.

But not all domestic brands struggled. OPPO grew 12%, and Vivo was up 8%. This proves that good mid-range phones and smart release schedules can still win. Consumers in China care deeply about new products and when they go on sale. The 11.11 event is now about launching current, hot items, not just clearing out old stock. Apple understood this perfectly.

The final sell-out figures prove that these changes show real customer interest. This data gives us a clear look at the competitive plans for 2026.

Read also

The 11.11 festival was mainly a win for Apple. Its success came at the expense of rivals who misjudged the sales calendar. Competitors must now rethink their entire launch cycle.

Key Takeaways

- Apple Dominates: Apple achieved a huge 37% year-on-year growth during China's 11.11 event.

- Base Model Win: The standard iPhone 17 doubled its sales volume due to key feature upgrades and steady pricing.

- Xiaomi Timing Issue: Xiaomi sales dropped 11% because their flagship 17 series launched too early, shifting its sales peak.

- Domestic Brands Split: Huawei (-22%) and Honor (-14%) struggled, while OPPO (+12%) and Vivo (+8%) still managed to grow.

- Strategic ASP Focus: Xiaomi accepted the short-term volume loss to pursue a higher Average Selling Price (ASP) earlier in the product cycle.

Popular News

Latest News

Loading