Amazon has launched a financial service that offers instant, zero-interest credit to customers, in India. It can be used to pay monthly bills, and buy products including groceries.

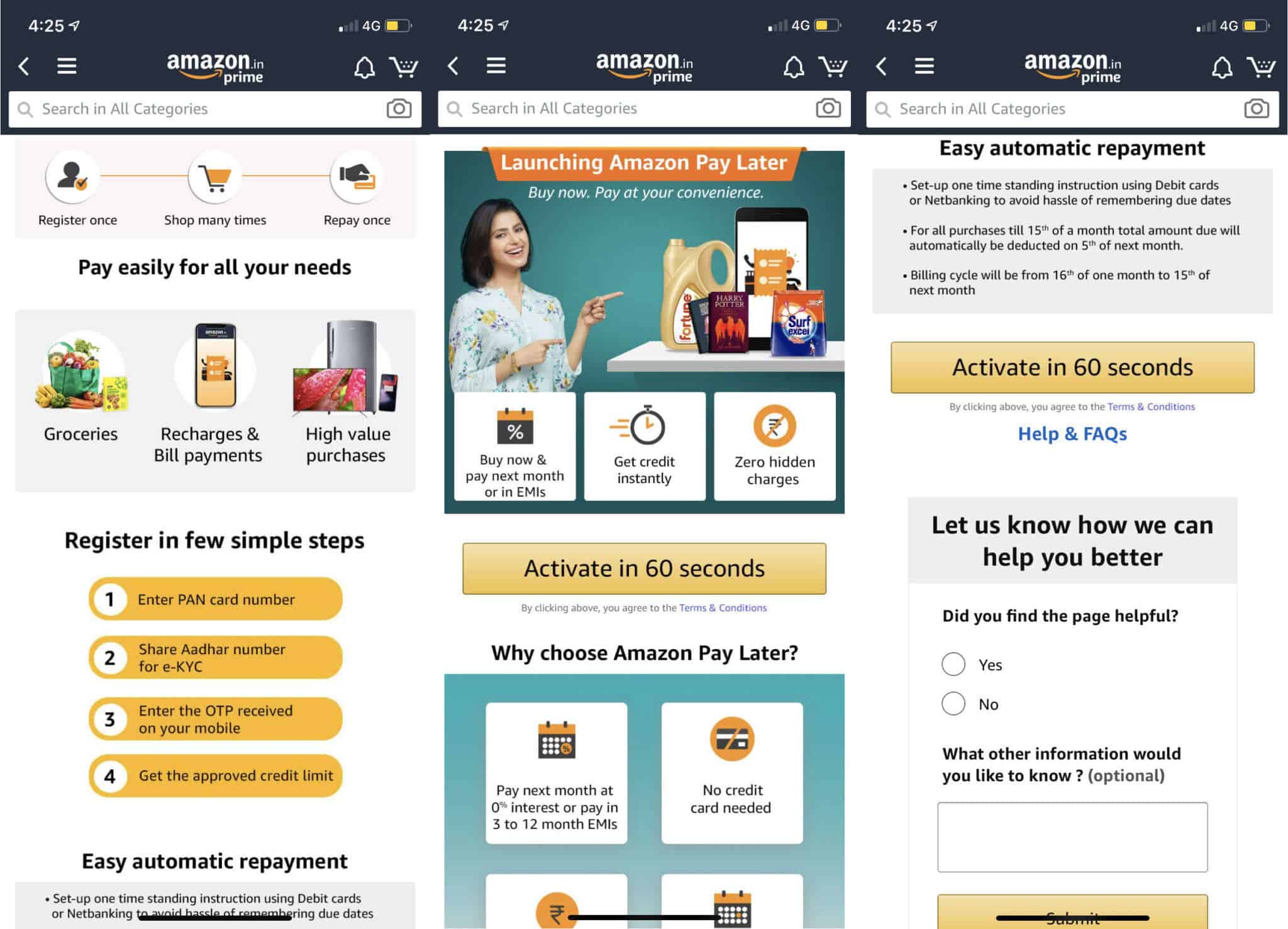

Amazon’s most ambitious financial service, Amazon Pay Later can lend money to customers in advance for products listed on the website. This is similar to it’s rival Flipkart but with more credit limit. Users can purchase any product from the website through this service. By availing this, Amazon will pay for the users on the purchase of the product and users will have to pay the due in the subsequent month. This service also allows users to pay bills such as electricity invoices, mobile recharges, water bills etc.

The pending amount can be paid in the next subsequent month following the purchase in a single payment or through an EMI of up to 12 months. The instalments paid through EMI mode of payment comes with a specified interest rate for every product based on the amount.

Gizchina News of the week

The rate of interest levied on EMI payments can also be waived if the purchased product supports the no-cost EMI option. Irrespective of this, the company will charge a nominal fee for payments made through EMI method. The credit limit given by Amazon is up to Rs.60,000. Customers can borrow any amount from Re.1 to Rs.60,000 based on RBI’s regulations. This is going to be a huge relief for consumers because Flipkart’s pay later has only up to Rs.5,000 as the limit.

Users can avail this feature through the Amazon mobile app by completing the KYC registration process on clicking the pay later option in settings. This mobile-only exclusive feature’s eligibility is dependent on factors including user’s credit history, previous purchases, account information etc.