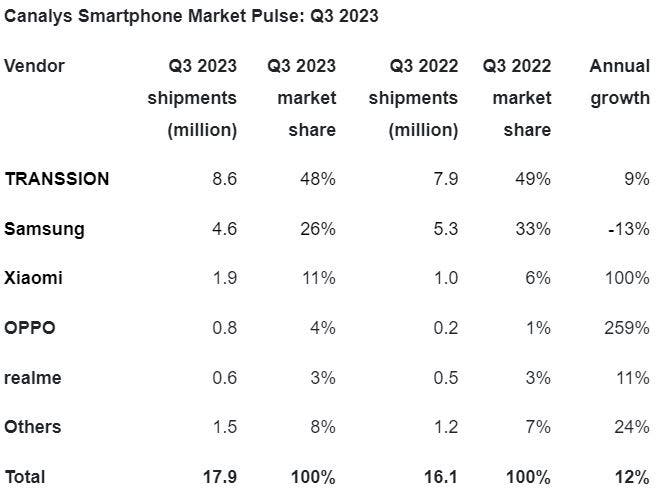

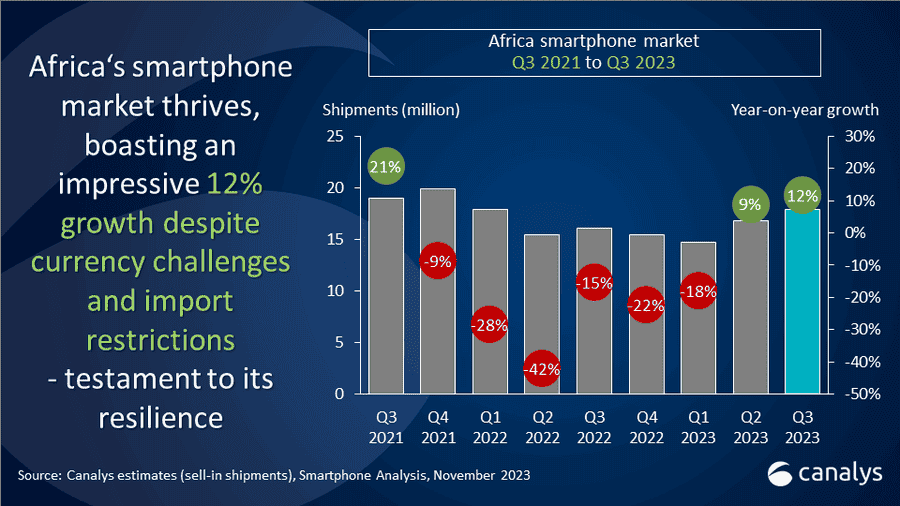

Xiaomi, a prominent player in the global smartphone market, has made significant strides in establishing its brand image in Africa. According to Canalys, in the third quarter of 2023, Xiaomi’s relevant market share in Africa increased by 100%, reflecting the company’s growing influence in the region. This growth is a testament to Xiaomi’s strategic expansion in emerging markets, particularly in Africa, where the smartphone market has demonstrated resilience and continued growth despite macro-volatility.

According to Canalys, Chinese brand Xiaomi is doing quite well in the African mobile phone market. However, Transsion which includes Tecno, Itel, and Infinix remains the leader in the African market. This brand has a long history in the African mobile phone market and this is why it is called the “King of Africa“. Transsion has 48% of the African mobile phone market share while Samsung comes second. Samsung also has a pretty decent history in the African market, especially with its mid-range and entry-level devices. The South Korean brand has 26% of the African market share. Chinese brand, Xiaomi is third with 11% of the market share. The company grew 100% in the third quarter to rebound from its second performance.

Canalys, as an independent analyst company, provides valuable insights into the smartphone market. The company’s data and analysis underscore Xiaomi’s remarkable growth and increasing market share in Africa, positioning the company as a key player in the region’s smartphone industry

Xiaomi’s Success in Africa

Xiaomi’s success in Africa can be attributed to its focus on offering competitive products in the sub-$100 price bracket, which has resonated well with consumers in the region. The company’s efforts to expand its footprint strategically in emerging markets have contributed to its significant market share growth in Africa.

Amid macroeconomic challenges, demand in the African market remains relatively stable. Canalys said that driven by power consumption restrictions, the demand for mid-range phones in the African market has also increased. At the same time, people are increasingly paying attention to high-quality screens and long-lasting smartphones to meet their entertainment needs during power outages.

Canalys mentioned, that Xiaomi has successfully established an ideal brand image among African consumers. So far, Xiaomi has used its cheaper Redmi brand to penetrate the African mobile phone market. Popular Xiaomi phones in Africa include Redmi A2, Note 12 4G, 12 and 12C. Xiaomi’s strategy in North African countries such as Egypt and Morocco has also been successful.

Gizchina News of the week

Canalys also claimed that the brand’s local team is taking advantage of its extensive asset layout and global product portfolio to consolidate its position in the African market. Honor and Xiaomi have impacted the market with diversified products that are extremely cost-effective. Faced with the challenge of consumers gradually switching to mid-range devices such as Xiaomi, OPPO and Realme, Samsung has placed more emphasis on “high-end” and promoted folding screen mobile phones to consolidate its market position in the high-end market.

Xiaomi’s history in the African mobile phone market

Xiaomi, the Chinese smartphone maker, has been making moves to sell its phones in Africa since 2015. Xiaomi partnered with the Mobile in Africa Group to sell two of its smartphones, the Redmi 2 and the Mi 4, in South Africa, Kenya, and Nigeria. Xiaomi’s global strategy director, Raymond Tian, said that they see Africa as the next frontier for smartphone growth. Xiaomi’s shipments in the whole of the African market grew by 33% year-on-year, and in South Africa, there was a surge of 537% year-on-year. In the Canalys report of 2021, Xiaomi ranked at number 3 in the smartphone market, which shows an annual growth of 66% in 2021. Xiaomi also accomplished a great sales performance in the African markets, with their market shares in Morocco soaring to 26%.

Xiaomi’s entry into the African market has not been without controversy. mi-Fone, the first African mobile devices brand established in 2008, objected to Xiaomi entering Africa with a similar name. Xiaomi’s shipments in the African market grew by 33% year-on-year, and in South Africa, there was a surge of 537% year-on-year. In the Canalys report of 2021, Xiaomi ranked number 3 in the smartphone market, which shows an annual growth of 66% in 2021.

Chinese smartphone brands, including Xiaomi, have been dominating the African market. Transsion Holdings, a China-based smartphone manufacturer, topped the African smartphone market in the fourth quarter of 2021. It recorded a combined unit share of 47%. Samsung placed second with a share of 21% in Africa. Africa’s mobile phone market enjoyed year-on-year growth of 14% in the first quarter of the year. Chinese products come in a wide range of prices to suit different groups of customers, which makes them more popular.

Final Words

In conclusion, Xiaomi’s success in Africa’s smartphone market is evident from its substantial growth and increasing market share. The company’s focus on offering competitive products in the sub-$100 price bracket and its strategic expansion in emerging markets has been instrumental in solidifying its brand image and market position in Africa. What do you think about the performance of Xiaomi in the African mobile phone market? Will the company continue to do well? Let us know your thoughts in the comment section below

Author Bio

Efe Udin is a seasoned tech writer with over seven years of experience. He covers a wide range of topics in the tech industry from industry politics to mobile phone performance. From mobile phones to tablets, Efe has also kept a keen eye on the latest advancements and trends. He provides insightful analysis and reviews to inform and educate readers. Efe is very passionate about tech and covers interesting stories as well as offers solutions where possible.