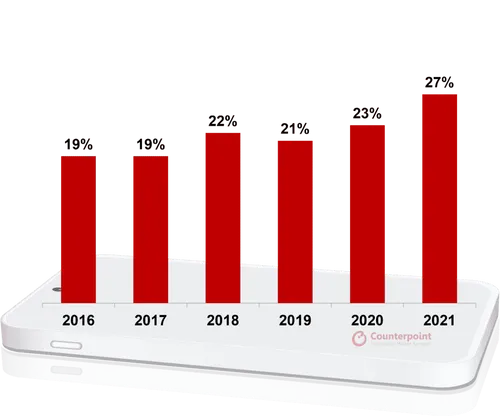

Sales of premium smartphones reach the highest level ever in 2021

Phones

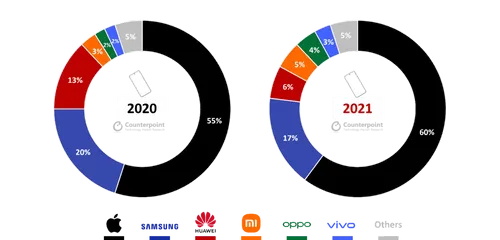

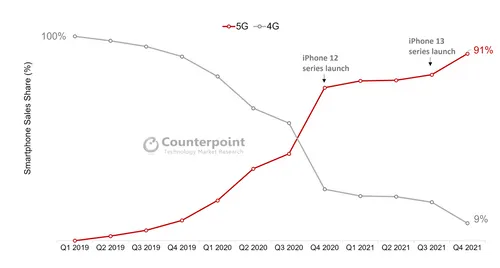

Commenting on the premium market growth in 2021, Research Director Tarun Pathak said, “The premium market growth in 2021 was driven by a mix of factors, including replacement demand, OEM strategies and supply chain dynamics. Upgrades to the affordable-premium segment in emerging economies and replacement demand for 5G devices in advanced economies continued to drive growth. OEMs including Apple, OPPO, vivo and Xiaomi were aggressive in capitalizing on the premium market gap left by Huawei, especially in China and Western Europe, driving growth in the segment. Amid the supply chain woes, the ecosystem players also prioritized the premium segment devices due to increased margins and profitability. The growth rate was also somewhat higher in 2021 due to the sales and launch schedules in 2020 being impacted by the pandemic.”

Sales of premium smartphones reach the highest level ever in 2021

Commenting on the premium segment outlook, Senior Analyst Varun Mishra said, “Going forward, the premium segment, driven by the replacement demand across markets, is likely to keep growing and outpace the global smartphone market growth. Another large opportunity driving the segment would be the installed base of Huawei users in China, which is approaching its replacement cycle. The competition in China’s premium segment has been strong, but Huawei maintaining its second position in 2021 indicates a future opportunity for other OEMs. Further, the launch of foldables at a lower price than before will also drive growth in the premium market. Samsung has showcased foldables as a viable market. A foldable phone from Apple will be a nod to the robustness of the technology and further drive growth.”

Loading