The End of an Era: Apple Set to Dethrone Samsung as World's Smartphone King by 2025!

AppleFriday, 28 November 2025 at 09:59

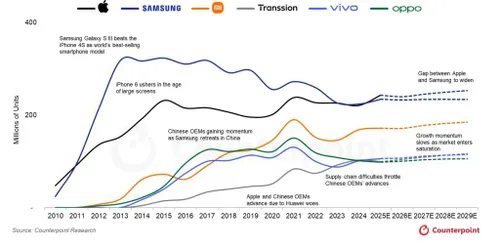

I don't think people realize how massive this is. Samsung has been the undisputed global smartphone leader for 14 years. It’s a ridiculous streak—a run that basically defined the post-Nokia mobile world. But according to Counterpoint Research, that era is over. Apple is projected to snatch the No. 1 spot by the end of this year, a title swap we haven't seen since 2011.

The Recipe for the Perfect Upset

The entire global smartphone market is barely growing, maybe 3.3% next year. Samsung is expected to do fine, hitting 4.6% growth. Fine. But Apple? They are predicted to surge by a staggering 10%! That’s more than double Samsung’s pace, giving Apple a projected 19.4% market share—just enough to push Samsung out of the crown.

Why the dramatic shift? It’s not one thing; it's a trifecta of aggressive, calculated moves:

- The iPhone 17's Unstoppable Momentum: The latest iPhone 17 line is performing like a juggernaut. We've seen sales jump 18% in China alone. That’s double-digit growth in a market known for crushing Western competitors. That is the engine driving this entire forecast.

- The Post-Pandemic Upgrade Crunch: Think about the millions who bought phones during the 2020 boom. Those devices are now hitting the point of exhaustion—dead batteries, cracked screens, slow performance. This replacement cycle is massive, and Apple is perfectly positioned to capture the bulk of that upgrade money.

- The Second-Hand Flywheel: This is genius. Over 358 million used iPhones traded hands between 2023 and mid-2025. What does that do? It hooks hundreds of millions of people into the iOS ecosystem—comfort, familiarity, the whole bit. They're locked in, and their next purchase? Almost certainly a new iPhone.

This Isn't a Blip—It’s the New Decade

Counterpoint isn't calling this a temporary win. They are calling this the new normal, predicting Apple will hold the No. 1 spot through at least 2029.

Samsung knows what’s coming. The search results show they are aggressively targeting a 10% sales jump in their 2026 foldables, making them thinner and lighter—a direct response to the rumored 2026 launch of the foldable iPhone. That foldable, by the way, is rumored to have a crease-free display and the largest battery ever in an iPhone, priced at a wild $2,399.

Read also

But Apple's strategy is two-pronged: go premium and go budget. The expected launch of the lower-cost iPhone 17e in 2026, reportedly adopting the Dynamic Island and an A19 chip, will replace the SE, drawing in new customers at a friendlier $599 price point.

The market has shifted. Samsung’s reign is dissolving right before our eyes, replaced by an Apple ecosystem that is aggressively expanding its premium grip while simultaneously plotting to dominate both the budget and foldable segments.

Key Points:

- Apple is projected to surpass Samsung in global annual smartphone shipments in 2025, ending a 14-year streak.

- Apple's projected 10% shipment growth far outpaces Samsung's 4.6% and the market's 3.3%.

- Success is driven by strong iPhone 17 sales and a massive upgrade cycle from pandemic-era phone purchases.

- The sale of 358 million used iPhones has created a locked-in future upgrade base for Apple.

- Analysts project Apple will maintain the No. 1 position through at least 2029, bolstered by a foldable iPhone and budget 17e model in 2026.

Popular News

Latest News

Loading